If you want a quick and secure way to borrow money, Palmpay has got you covered. This digital wallet service lets you send and receive money from anyone, anywhere in the world.

Guess what? You can borrow money with Palmpay, and you get credited within minutes. It’s fast, easy, and safe, read on to discover how you can borrow money from Palmpay with this guide.

What is Palmpay?

Palmpay is a mobile banking application that offers a variety of secure and convenient financial services, including sending and receiving money globally.

The app’s borrowing feature allows you to manage your finances more effectively by providing easy access to loans from anyone. Stay tuned for our upcoming sections to learn more about setting up your Palmpay account and utilizing its borrowing options.

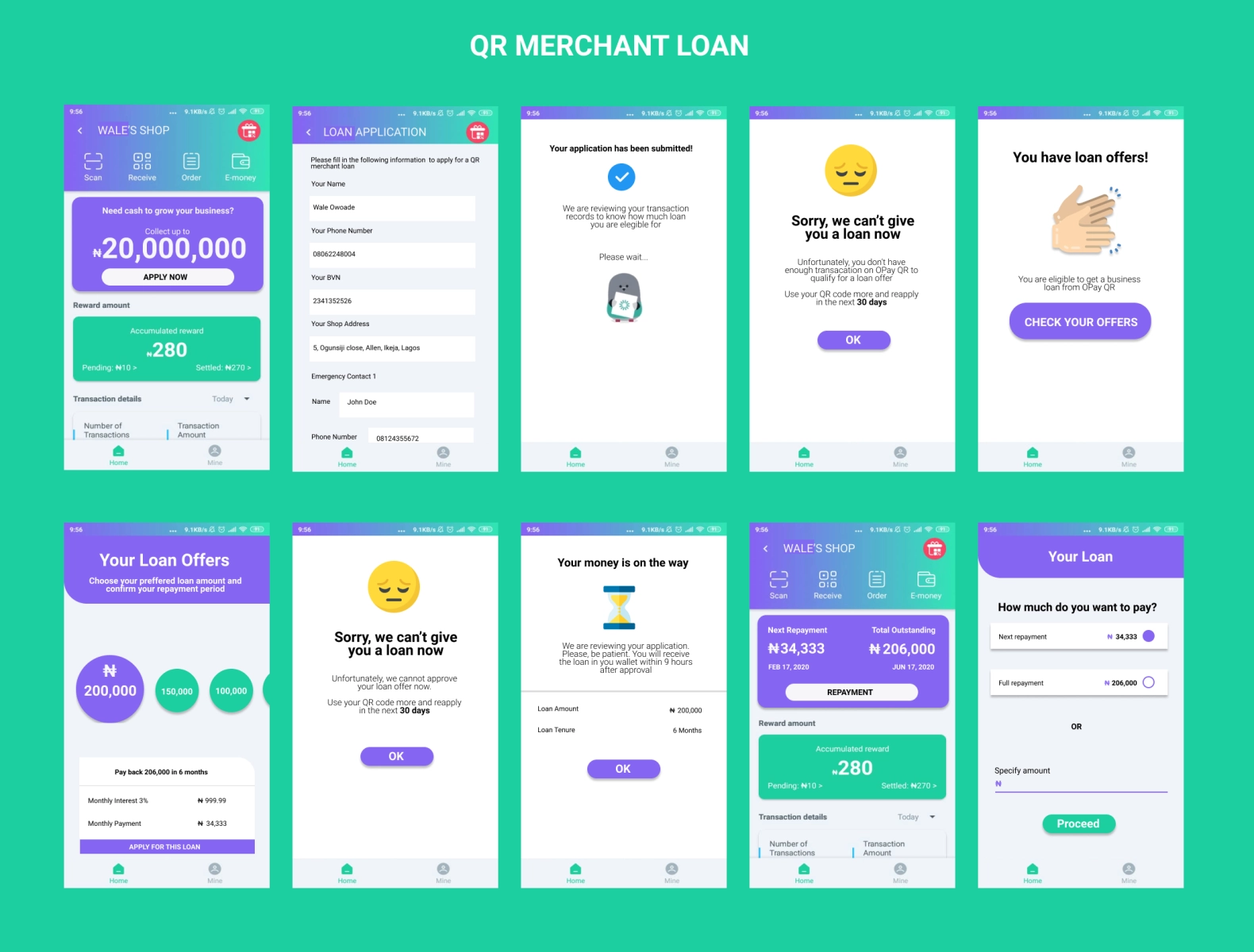

Read also: How To Borrow Money From Opay App 2023, Interest Rate%

How PalmPay Loan Works

PalmPay loan, which on the app is known as Flexi Cash, is a loan service that offers low-interest collateral-free loans to PalmPay users.

With loan amounts ranging up to N50,000 and a suitable repayment tenor of 16 to 30 days, with it, you will have the flexibility to borrow the funds you need without the stress of immediate repayment.

If you find yourself needing more time, PalmPay allows you to extend your loan, although there is a cost associated with it.

Getting a loan from PalmPay is incredibly easy, all you need is an account and a few other requirements. Let’s dive into the details!

PalmPay loan requirements

If you’re wondering how I can borrow money from PalmPay, you need to meet certain eligibility requirements, and here are the requirements you need:

- Nigerian citizenship

- Registered PalmPay account

- Optional: Valid Bank Verification Number (BVN)

- Optional: Valid means of identification (e.g., National ID card, driver’s license, or international passport)

Once you meet these requirements, you’re eligible to apply for a PalmPay loan. Now, let’s find out how to get a loan on PalmPay.

Steps to borrow from Palmpay

To borrow money from Palmpay, follow these simple steps:

- Download the PalmPay App by clicking here and then create an Account.

- Log in to your PalmPay account on the mobile app.

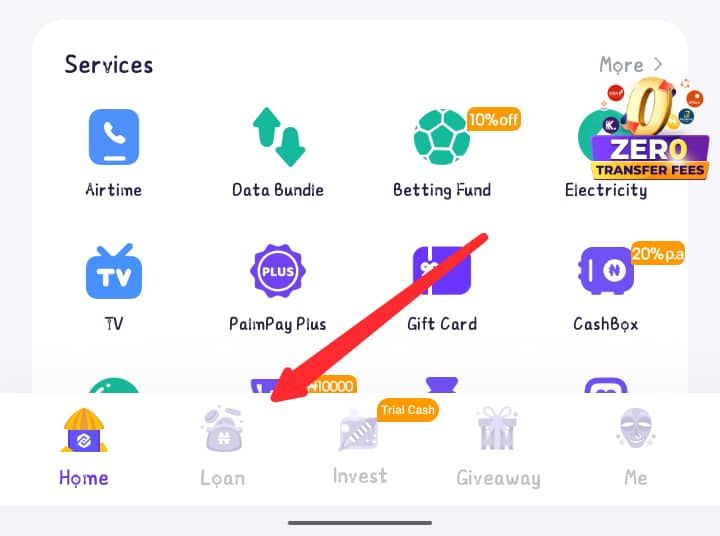

- Click on the “Loan” tab at the bottom of the homepage.

- Look for the “Flexi Cash” option and click on “Borrow Now”.

- As a new user, fill out the loan application form with accurate information about yourself, including your name, phone number, and address.

- Go with your current limit or enter the loan amount you want to borrow.

- Review your loan application details and click on “Submit”.

- Once you’ve submitted your loan application, PalmPay will review it and notify you of the loan’s approval or rejection within a few minutes or hours.

With these easy steps, you’ll be on your way to borrowing money from PalmPay in no time.

Read Also: How To Apply For Student Loan In Nigeria 2024, Interest Rate%

About The New Palmpay Loan Code

There is now a pattern to access the Palmpay Loan with a USSD code, simply dial *652# on your mobile phone. This will provide you with a set of instructions for you to apply for a loan through the Palmpay digital banking service.

The code will guide you through the loan application process, allowing you to borrow money quickly and conveniently just as you can do on the mobile app but this time you will do it without any data subscription.

Unique PalmPay Loan Interest Rate

PalmPay offers a flexible loan interest rate that ranges from 15% to 30% for a loan period of 30 days. That translates to around 0.80% per day. However, it’s important to note that your specific interest rate may vary depending on your credit score.

Those with good credit scores are likely to secure lower interest rates, while borrowers with poor credit scores may face higher rates. Additionally, it’s crucial to repay your PalmPay loan on time to avoid any increase in interest charges. So, make sure you stay on top of your repayment schedule to get the most out of your loan experience with PalmPay.

Frequently Asked Questions

How much can I borrow from PalmPay for the first time?

With PalmPay, you have the freedom to borrow any amount between ₦5000 and ₦200,000, giving you the flexibility to address any financial needs, be it for an emergency or a major expense.

The repayment terms are agreed upon in advance, allowing you to easily repay the loan amount as per your convenience.

Can I borrow 200k from PalmPay?

Yes, you can definitely borrow ₦200,000 from PalmPay. The best part is that you don’t need to go through any lengthy paperwork or provide collateral.

With just a few taps on your phone, you can access a loan instantly. The interest rate will depend on your credit score and the loan amount you want, ranging from 15% to 30%. So, if you need a substantial amount of money quickly, PalmPay has got you covered.

Can I withdraw the money I borrow from PalmPay?

Yes, you can definitely withdraw the money you borrow from PalmPay. Once your loan is approved and the funds are disbursed to your PalmPay account, you have full access to them.

You can withdraw the money to your bank account or use it for any other financial needs like for airtime data subscription topup or any other bill payment you may have.

Whether it’s for paying bills, making purchases, or handling emergencies, PalmPay gives you the flexibility to use the borrowed funds as you see fit.

Conclusion

Palmpay offers a quick and secure way to borrow money, with their mobile banking application, you can easily set up an account and access loans from anyone.

By following the simple steps outlined in this article you should be able to borrow money from Palmpay in no time.

However, remember to meet the loan requirements and make timely repayments to maintain a good borrowing record.