If you need to borrow money and want to know how to borrow money from Opay, you’re in the right place. Opay offers a streamlined and secure process for borrowing money through their mobile application.

In this article, we will guide you through the steps of borrowing money from Opay and provide some essential information about their loan services.

Read Also: How To Check My Lost Voters Card Online

What Is Opay?

Opay is a mobile application that provides various financial services, including payments, transfers, loans, and more. With millions of registered users in Nigeria, Opay has become a popular platform for financial transactions.

Their user-friendly app and efficient services make it convenient for individuals to access loans and other financial solutions.

Steps To Borrow Money From Opay

To borrow money from Opay, follow these simple steps;

- Download the Opay Mobile App: Visit your device’s app store and download the Opay mobile app. It is available for both Android and iOS devices.

- Create an Opay Account: Open the app and follow the registration process to create an Opay account. You may need to provide some personal information and verify your identity.

- Log in to Your Opay Account: Once you have created an account, log in to your Opay account using your registered credentials.

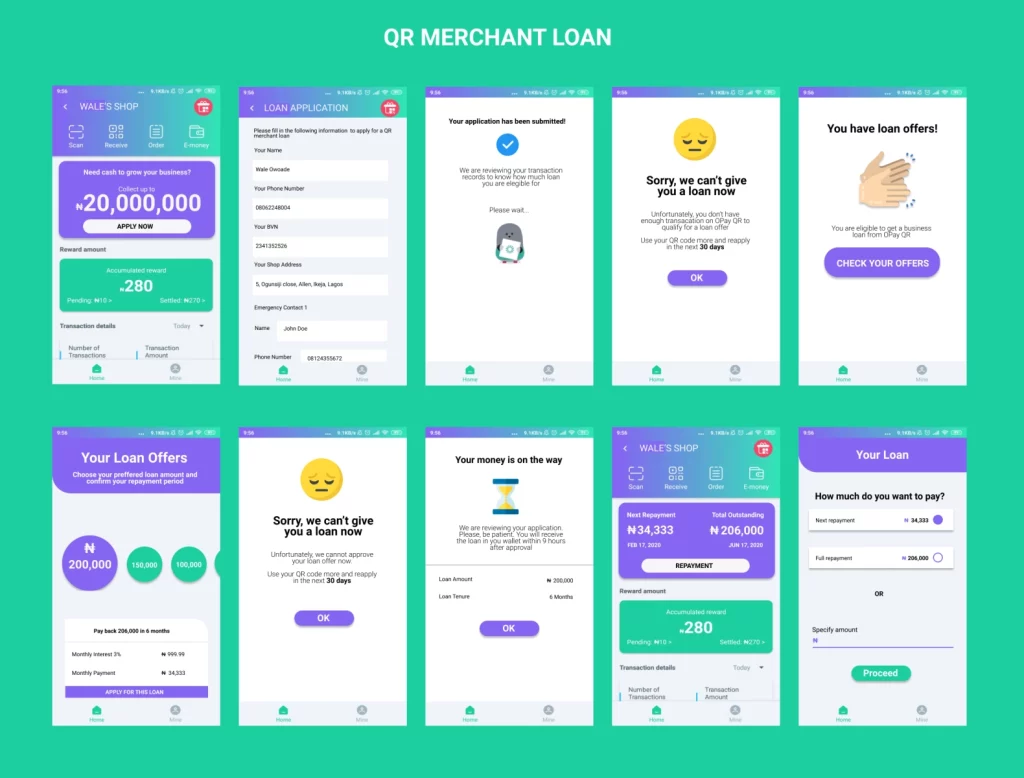

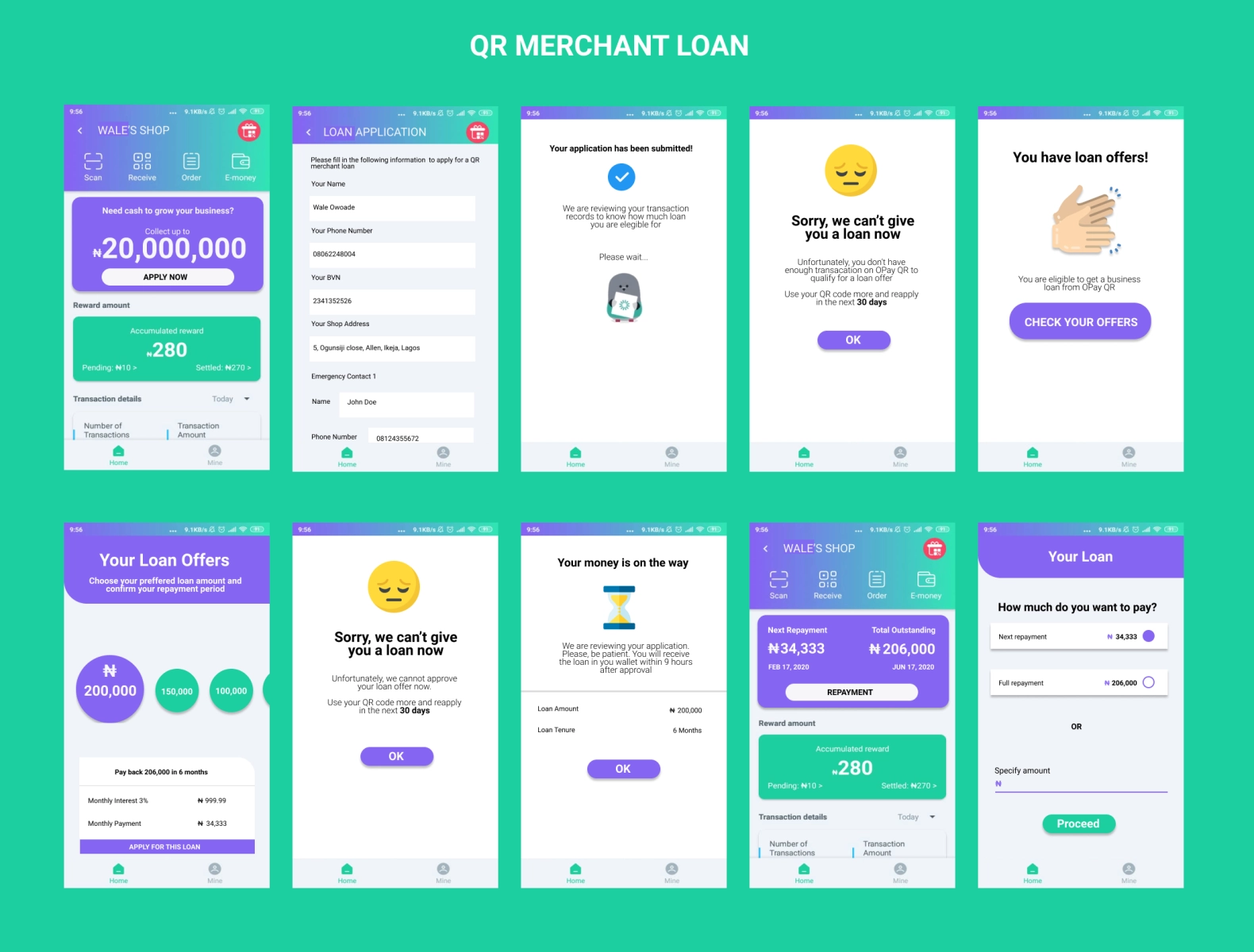

- Access the Loan Services: Within the Opay app, navigate to the loan section or finance section to access the loan services.

- Apply for a Loan: Follow the instructions provided within the app to apply for a loan. You may need to provide additional information, such as your employment details, income, and loan amount.

- Submit Your Loan Application: After providing the required information, submit your loan application through the app.

- Wait for Approval: Opay will review your loan application and notify you about its status. The approval process may take some time, so be patient.

- Receive the Loan Amount: If your loan application is approved, the loan amount will be disbursed to your Opay account.

Opay offers different types of loans, such as personal loans, business loans, and student loans. The loan terms and interest rates may vary depending on the type of loan and your eligibility.

Types of loans, Benefits, And Percentages Available On Opay Loan

Different types of loans, including personal loans, business loans, and student loans are available when you borrow money from Opay, the interest rate for Opay loans ranges from 5% to 15%, depending on the type of loan and the repayment period you opt for.

To repay an Opay loan, simply ensure that you have sufficient funds in your Opay account on the due date. Opay will automatically deduct the loan amount and interest from your account when it’s due.

Taking out a loan from Opay comes with several benefits, such as quick access to funds, flexible repayment options, and competitive interest rates. Additionally, Opay offers personalized loan options tailored to individual customer needs.

Eligibility Requirements For Borrowing Money From Opay

To be eligible for a loan with OPay, you must have an active OPay account with a BVN (Bank Verification Number) and a transaction history on the platform.

How To Register For An OKash Loan

Here is A Step-by-Step Guide to registering for a loan on the Okash loan app:

- Install the OKash APP from the Play Store

To begin the registration process, you’ll need to download the OKash app from the Play Store. Once the download is complete, proceed to install the app on your mobile device. For iOS users, please download the app from the App Store instead.

- Create an Account

After successfully installing the app, it’s time to register for an account. Locate and tap the “Register” button within the app’s interface. You’ll be prompted to provide necessary details such as your name, mobile phone number, email address, and ID number. Once you’ve filled in the required information, create a secure password, and finalize the registration by clicking on the “Register” button.

- Select Your Desired Product

Once you’ve completed the registration process, log in to the app using your newly created account. Within the app, you’ll find an option labeled “Apply Now.” Tap on this button to access various loan options available. Choose the OKash loan that suits your needs and click on the “Apply Now” button to proceed.

- Providing Your Basic Information and Submitting the Application

In this step, you’ll need to provide additional information required for your loan application. Fill in details regarding your income and other personal information as requested. Once you’ve completed the form, review your entries and submit the application for processing.

- Verify by a Call

After submitting your application, it is possible that the Opay team will contact you for verification purposes. It is important to answer this call and cooperate with the team to ensure a smooth process. Verify your details with them accurately to proceed further.

- E-Signing the Loan Agreement

Upon approval of your application, you will receive a notification on your mobile phone. Take your time to carefully review the terms and conditions of the loan agreement. If you agree to the terms, proceed to e-sign the loan agreement using the provided method. Once the agreement is signed, the funds will be disbursed to your Opay account, which can be accessed conveniently through your mobile phone.

By following these step-by-step instructions, you can easily register for an OKash loan and access the funds you need. Good luck with your loan application.

How Much Can I Borrow From Opay For The First Time?

The minimum amount you can request from Opay’s Okash service at the moment is 30,000 Naira, and the maximum amount for a first-time user is 50,000 Naira. This means that as a first-time user, you can request up to 50,000 Naira for your initial loan on Opay.

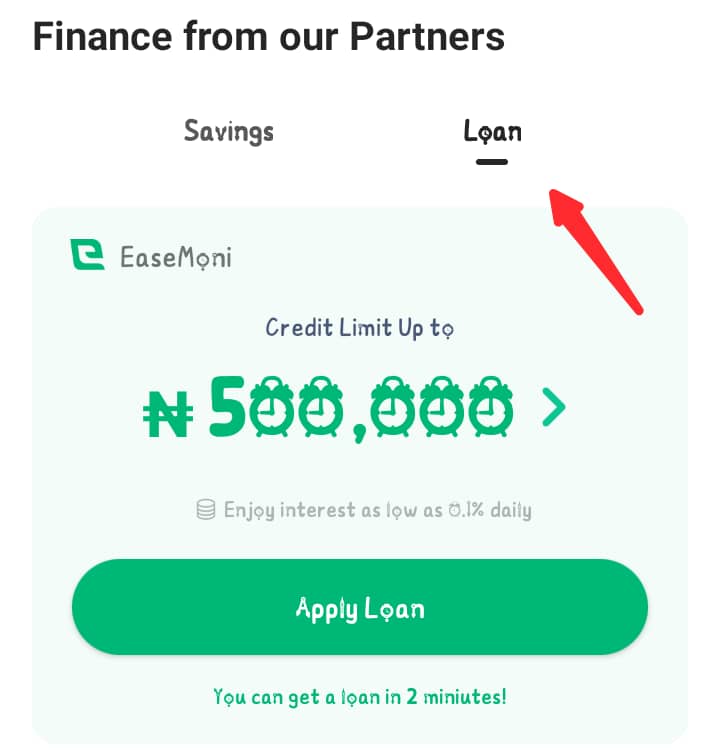

For Easimoni, the minimum amount you can borrow as a first-time user is 1,000 naira. However, please note that the exact minimum amount may vary depending on the specific lender and your creditworthiness.

It’s essential to consider your financial needs carefully and borrow only the amount that you can comfortably repay within the agreed-upon terms.

Is OKash The Same As OPay?

Yes, Opay is a mobile wallet service that offers financial services like bill payments, airtime recharges, and money transfers. Okash, on the other hand, is a mobile lending service owned by OPay.

Important Considerations

- Before borrowing money from Opay or any other financial institution, carefully review the terms and conditions of the loan. Understand the interest rates, repayment schedule, and any additional fees associated with the loan.

- Borrow only what you can afford to repay. Consider your financial situation and ensure that you can comfortably repay the borrowed amount within the specified time.

- Maintain a good repayment record. Timely repayment of your loans can help you build a positive credit history, which may increase your chances of borrowing larger amounts or accessing better loan terms in the future.

Conclusion

Borrowing money from Opay is a convenient and straightforward process. By following the steps outlined above and considering the important considerations, you can access the funds you need quickly and efficiently. Remember to borrow responsibly and use the loan amount wisely to meet your financial needs.

I need loan

Hey Allen, you can install the Opay app and follow the procedures highlighted here to request for loan.