JAMB Principles Of Accounts Syllabus 2024/2025: Is JAMB Syllabus for Principles Of Accounting out for this year’s JAMB? when will JAMB syllabus for Principles Of Accounts be out?” what topics do JAMB set questions for Principles Of Accounts the most? what is the most repeated topic in Accounts ?

Welcome SAVANT! to another exciting episode of “JAMB Doctor Series” in this episode we will provide you with the official topics recognize by JAMB, which you are expected to be a guru in before entering the hall to sit for your JAMB Exam for Principles Of Accounts. STAY TUNED!

Have you ever wondered where you can find the topics for Principles Of Accounts JAMB asks or the most repeated topics or questions? then you are a step away from finding your answer.

JAMB Syllabus is the only expo you will be getting as you prepare for your UTME exams, this syllabus contains area of concentrations and topics your questions will be asked from.

Read Also: WAEC Marking Scheme For All subjects: Grading System

ARE YOU ON TELEGRAM? Subscribe To My Telegram Channel For Frequent Updates & Guide by clicking the "SUBSCRIBE NOW" button below.

Any smart students would cherish this piece (Syllabus) and make effective use of it, the fact that you are searching for this now, simply means you are in the right direction. You should see my top notch guide on How To Pass JAMB With High Score (300+).

What Is JAMB Principles Of Accounts Syllabus?

JAMB Syllabus for Principles Of Accounts is a collection of topics the board expects you to be well grounded in before the exam.

If Principles Of Accounts is one of the subjects you will sit for in JAMB, then you need this syllabus, these were actually compiled by JAMB, so it is something you can rely on.

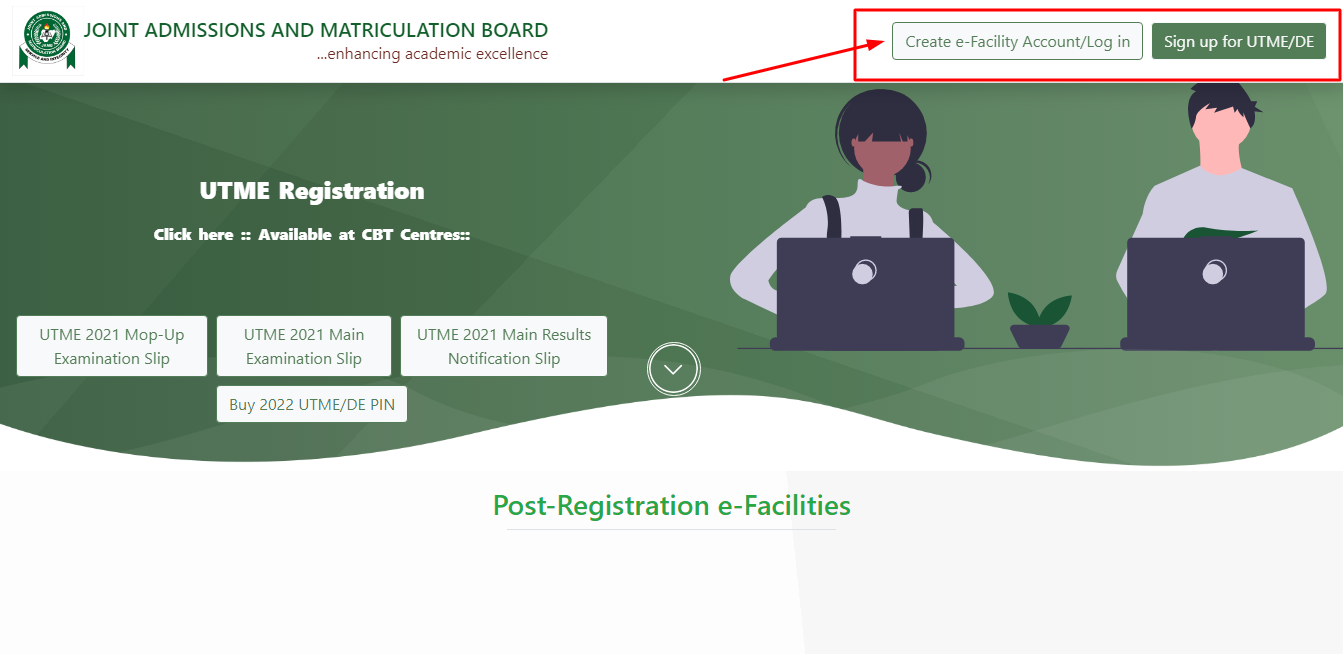

Read also: JAMB Profile 2024/2025: How To Create & Access It (All To Know)

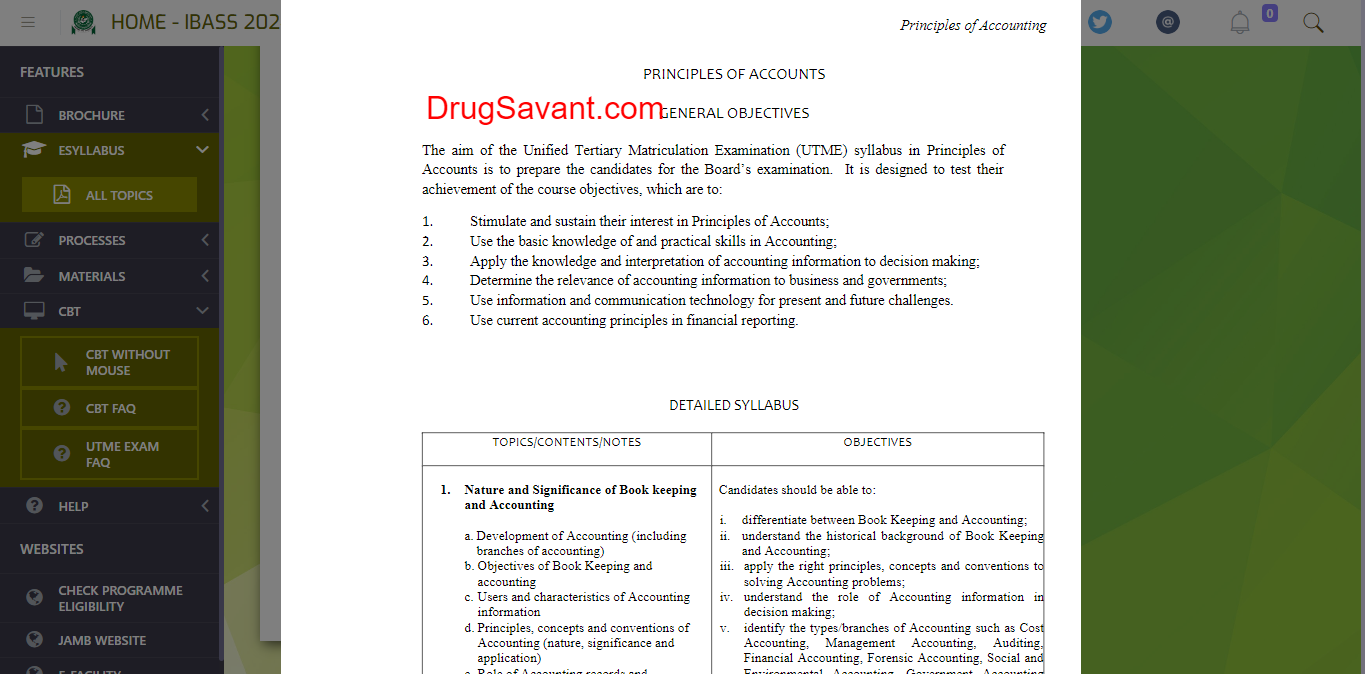

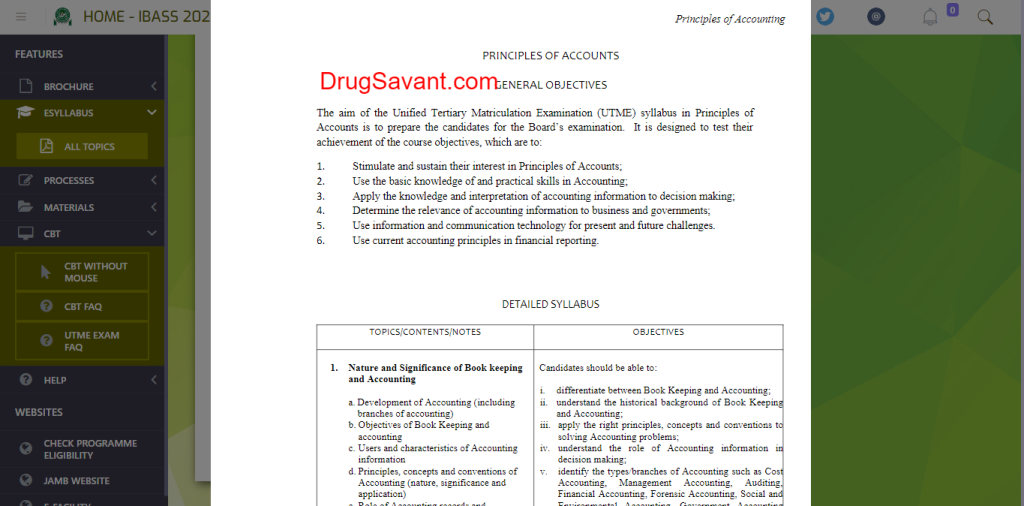

JAMB Syllabus For Principles Of Accounts

JAMB Principles Of Accounts syllabus is designed to evaluate your ability to:

- Stimulate and sustain their interest in Principles of Accounts;

- Use the basic knowledge of and practical skills in Accounting;

- Apply the knowledge and interpretation of accounting information to decision making;

- Determine the relevance of accounting information to business and governments;

- Use information and communication technology for present and future challenges.

- Use current accounting principles in financial reporting.

Download your copy of the syllabus using the download link below👇

Below is a detailed syllabus for JAMB Principles Of Accounts, you can bookmark this page for easy access to this page. ENJOY!

1. Nature and Significance of Accounting

Topics:

- Development of accounting (including branches of accounting)

- Objectives of bookkeeping and accounting;

- Users and characteristics of Accounting information

- Principles, concepts and conventions of accounting (nature, significance and application)

- Role of accounting records and information

2. Principles of Double Entry

Topics:

- Functions of source documents

- Books of original entry

- Accounting equation

- The ledger and its classifications

- Trial balance

- Types and treatment of errors and uses of suspense account

3. Ethics in Accounting

Topics:

- Objectives

- Qualities of an Accountant

4. Cashbook

Topics:

- Columnar cashbooks

- Discounts

- Petty cashbook and the imprest system

5. Bank Transactions and Reconciliation Statements

Topics:

- Instrument of bank transactions

- e-banking system

- Courses of discrepancies between cashbook and bank statement

- Bank reconciliation statement

6. The Final Accounts of a Sole Trader

Topics:

- Income statement (Trading and profit and loss account)

- Statement of financial position (Balance sheet)

- Adjustments:

- provision for bad and doubtful debt

- iprovision for discounts

- provision for depreciation using straight-line and reducing balance methods

- accruals and prepayments

7. Stock Valuation

Topics:

- Methods of cost determination using FIFO, LIFO and simple average

- The advantages and disadvantages of the methods

- The importance of stock valuation

8. Control Accounts and Self-balancing Ledgers

Topics:

- Importance of control accounts

- Purchases ledger control account

- Sales ledger control account

9. Incomplete Records and Single Entry

Topics:

- Conversion of single entry to double entry

- Determination of missing figures

- Preparation of final accounts from incomplete records

10. Manufacturing Accounts

Topics:

- Cost classification

- Cost apportionment

- Preparation of manufacturing account

11. Accounts of Not-For-Profit-Making Organizations.

Topics:

- Objectives of Not-For-Profit-Making organizations

- Receipts and payments account

- Income and expenditure account

- Statement of financial position (Balance sheet)

12. Departmental Accounts

Topics:

- Objectives

- Apportionment of expenses

- Departmental trading and profit and loss account

13. Branch Accounts

Topics:

- Objectives

- Branch accounts in the head office books

- Head office account

- Reconciliation of branch and head office books

14. Joint Venture Accounts

Topics:

- Objectives

- Personal accounts of venturers

- Memorandum Joint venture accounts

15. Partnership Accounts

Topics:

- Formation of partnership

- Profit and loss account

- Appropriation account

- Partners current and capital accounts

- Treatment of goodwill

- Admission/retirement of a partner

- Dissolution of partnership

- Conversion of a partnership to a company

16. Introduction to Company Accounts

Topics:

- Formation and classification of companies

- Issue of shares and debentures

- Final accounts of companies

- Interpretation of accounts using ratios.

- Distinction between capital and revenue reserves

17. Public Sector Accounting

Topics:

- Comparison of cash and accrual basis of accounting

- Sources of government revenue

- Capital and recurrent expenditure

- Consolidated revenue fund

- Statement of assets and liabilities

- Responsibilities and powers of:

- The Accountant General

- The Auditor General

- The Minister of Finance

- The Treasurer of local government

- Instruments of financial regulation

18. Information Technology in Accounting

Topics:

- Manual and computerized accounting processing system

- Processes involved in data processing

- Computer hardware and software

- Advantages and disadvantages of manual and computerized accounting processing system

Frequently Asked Questions

How Many Questions JAMB Sets In Principles Of Accounts?

The total number of questions JAMB asked in Principles Of Accounts is 40, with each question carrying 2.5 marks.

This means if after answering Principles Of Accounts, you were able to answer 30 questions correctly in JAMB you have been able to secure 75 marks for yourself.

JAMB Recommended Textbooks For Principles Of Accounts

To make sure your reading is inline with what your should know, JAMB has prepared a list of textbooks that will help you achieve that purpose.

Is JAMB Principles Of Accounts Syllabus For 2024 Out?

Yes, JAMB syllabus for Principles Of Accounts is out.

In Conclusion

It is advisable you go through these topics listed here, as they would help you have a more directed preparation and reading for Principles Of Accounts in JAMB.

This will be all for now, I understand you may have a question or two to ask, feel free to drop them using the comment box below!

Ensure to share this with friends on Facebook, Whatsapp, or any other social media network you can connect them with…

Related Searches... a. Jamb principles of accounting syllabus pdf download b. Jamb principles of accounting syllabus pdf c. Jamb principles of accounting syllabus 2021 pdf d. Jamb principles of accounting syllabus 2021