JAMB Economics Syllabus 2024/2025: Is JAMB Syllabus for Economics out for this year’s JAMB?, When will JAMB Economics syllabus be out?, What topics do JAMB set questions from Economics?, what is the most repeated topic in JAMB Economics?

Welcome SAVANT! to another exciting episode of my “JAMB Doctor Series“, here I will provide you with the official topics recognize by JAMB, which JAMB expect you are a guru in before entering the hall to sit for your JAMB Economics Exam. STAY TUNED!

Have you ever wondered where you can find the topics for Economics JAMB normally asks or the most repeated topics or question in JAMB Economics? then you are a step away from finding your answer.

The short answer to the above question is “JAMB Syllabus”, in fact, JAMB Syllabus is the only expo you will be getting as you prepare for 2024/2025 UTME Exams, this syllabus contains area of concentrations and topics your questions will be asked from.

Read Also: WAEC Marking Scheme For All subjects: Grading System

ARE YOU ON TELEGRAM? Subscribe To My Telegram Channel For Frequent Updates & Guide by clicking the "SUBSCRIBE NOW" button below.

Any smart students would cherish this piece (Syllabus) and make effective use of it, the fact that you are searching for this now, simply means you are in the right direction. you should see my top notch guide on How To Pass JAMB 2024/2025 With High Score (300+).

For the sake of students who do not fully understand what JAMB syllabus is, I will give a brief explanation about this and then provide you with the relevant topics and area of concentration as provided in JAMB Economics Syllabus

I will also make the pdf available for download at the end of this write up… Enjoy!

What Is JAMB Economics Syllabus?

JAMB Syllabus for Economics is a collection of topics JAMB expects students to be well grounded in before they sit for their Economics exam. If Economics is one of the subjects you will sit for in JAMB, then you need this syllabus.

This syllabus were actually compiled by JAMB, so it is something you can rely on.

The aim of the Unified Tertiary Examination Board Syllabus in Economics is to guide candidates in their preparation for the Board’s exam.

Advantages of Using JAMB Economics Syllabus To Prepare?

Of course using JAMB syllabus to prepare for Economics in JAMB has its perks, some of these advantages includes…

- Expose you to topics you never taught were important

- You begin to see how JAMB thinks, and also expose you to what you should expects in different topics

- On the syllabus is also contained recommended textbooks, using JAMB recommended textbooks is key

With these I hope you will grab the opportunity of making good use of JAMB Economics Syllabus I will be providing you with shortly…

Read Also: JAMB Profile 2024/2025: How To Create & Access It (All To Know)

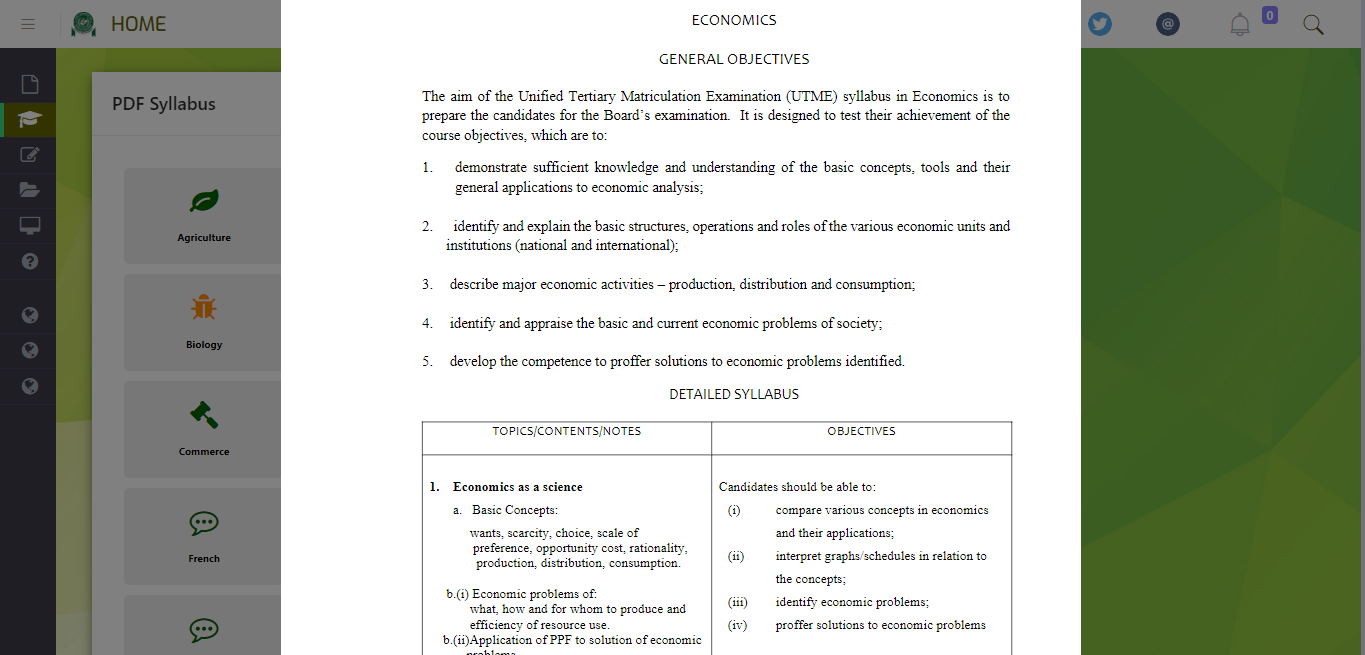

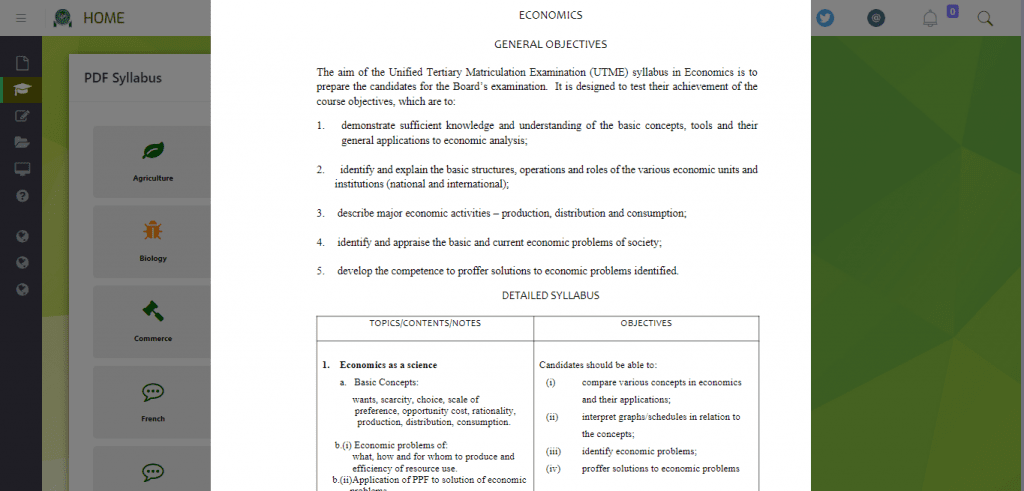

JAMB Economics Syllabus

JAMB Economics syllabus is designed to evaluate your ability to:

- Demonstrate sufficient knowledge and understanding of the basic concepts, tools and their general applications to economic analysis;

- Describe major economic activities – production, distribution and consumption;

- Identify and appraise the basic and current economic problems of society;

- Develop the competence to proffer solutions to economic problems identified.

Download your copy of the syllabus here👇

Below is a detailed list of JAMB Economics syllabus/Content

1. Economics as a science

Topics:

- Basic Concepts: Wants, Scarcity, choice, scale of preference, opportunity cost, Rationality, production, distribution, consumption.

- Economic problems of; What, how, and for whom to produce and efficiency of resource use.

- Application of PPF to solution of economic problems.

Study Objectives:

You should be able to:

- compare various concepts in economics and their applications;

- interpret graphs/schedules in relation to the concepts;

- identify economic problems;

- proffer solutions to economic problems

2. Economic Systems

Topics:

- Types; free enterprise centrally planned and mixed economies

- Solutions to economic problems under different systems

- Contemporary issues in economic systems (economic reforms e.g deregulation, banking sector consolidation, cash policy reform).

Study Objectives:

Candidates should be able to:

- compare the various economic systems;

- apply the knowledge of economic systems to contemporary issues in Nigeria

- proffer solutions to economic problems in different economic systems.

3. Methods and Tools of Economic Analysis

Topics:

- Scientific Approach:

- inductive and deductive methods

- positive and normative reasoning

- Basic Tools

- tables, charts and graphs

- measures of central tendency: mean, median and mode, and their applications.

- measures of dispersion; variance, standard deviation, range and their applications;

- merits and demerits of the tools.

Study Objectives:

Candidates should be able to:

- distinguish between the various forms of reasoning;

- apply these forms of reasoning to real life situations;

- use the tools to interpret economic data;

- analyse economic data using the tools;

- assess the merits and demerits of the tools.

4. The Theory of Demand

Topics:

- Meaning and determinants of demand

- demand schedules and curves

- the distinction between change in quantity demanded and change in demand.

- Types of demand: Composite, derived, competitive and joint demand:

- Types, nature and determinants of elasticity and their measurement – price, income and cross elasticity of demand:

- Importance of elasticity of demand to consumers, producers and government.

Study Objectives:

Candidates should be able to:

- identify the factors determining demand;

- interpret demand curves from demand schedules;

- differentiate between change in quantity demanded and change in demand;

- compare the various types of demand and their interrelationships;

- relate the determinants to the nature of elasticity;

- compute elasticities;

- interpret elasticity coefficients in relation to real life situations.

5. The Theory of Consumer Behavior

Topics:

- Basic Concepts:

- utility (cardinal, ordinal, total average and marginal utilities)

- indifference curve and budget line.

- Diminishing marginal utility and the law of demand.

- Consumer equilibrium using the indifference curve and marginal analyses.

- Effects of shift in the budget line and the indifference curve.

- Consumer surplus and its applications.

Study Objectives:

You should be able to:

- appraise the various utility concepts

- apply the law of demand using the marginal utility analysis

- use indifference curve and marginal analyses to determine consumer equilibrium

- associate the income and substitution effects

- apply consumer surplus to real-life situations.

6. The Theory of Supply

Topics:

- Meaning and determinants of supply

- Supply schedules and supply curves

- the distinction between change in quantity supplied and change in supply

- Types of Supply: Joint/complementary, competitive and composite

- Elasticity of Supply: determinants, measurements, nature and applications

7. The Theory of Price Determination

Topics:

- The concepts of market and price

- Functions of the price system

- Equilibrium price and quantity in product and factor markets

- Price legislation and its effects

- The effects of changes in supply and demand on equilibrium price and quantity.

8. The Theory of Production

Topics:

- Meaning and types of production

- Concepts of production and their interrelationships (TP, AP, MP and the law of variable proportion).

- Division of labour and specialization

- Scale of Production: Internal and external economies of scale and their implications.

- Production functions and returns to scale

- Producers’ equilibrium isoquant – isocost and marginal analyses.

- Factors affecting productivity.

9. Theory of Costs and Revenue

Topics:

- The concepts of cost: Fixed, Variable, Total Average and Marginal

- The concepts of revenue: Total, average and marginal revenue;

- Accountants’ and Economists’ notions of cost

- Short-run and long-run costs

- The marginal cost and the supply curve of a firm.

Study Objectives:

Candidates should be able to:

- explain the various cost concepts

- differentiate between accountants’ and economists’ notions of costs

- interpret the short-run and long-run costs curves

- establish the relationship between marginal cost and supply curve.

- explain the various revenue concepts.

10. Market Structures

Topics:

- Perfectly competitive market:

- Assumptions and characteristics;

- Short-run and long-run equilibrium of a perfect competitor;

- Imperfect Market:

- Pure monopoly, discriminatory monopoly and monopolistic competition.

- Short-run and long-run equilibrium positions.

- Break-even/shut-down analysis in the various markets.

11. National Income

Topics:

- The Concepts of GNP, GDP, NI, NNP

- National Income measurements and their problems

- Uses and limitations of national income estimates

- The circular flow of income (two and three-sector models)

- The concepts of consumption, investment and savings

- The multiplier and its effects

- Elementary theory of income determination and equilibrium national income.

12. Money and Inflation

Topics:

- Types, characteristics and functions of money

- Demand for money and the supply of money

- Quantity Theory of money (Fisher equation)

- The value of money and the price level

- Inflation: Types, measurements, effects and control

- Deflation: Measurements, effects and control.

13. Financial Institutions

Topics:

- Types and functions of financial institutions (traditional, central bank, mortgage banks, merchant banks, insurance companies, building societies);

- The role of financial institutions in economic development;

- Money and capital markets

- Financial sector regulations

- Deposit money banks and the creation of money

- Monetary policy and its instruments

- Challenges facing financial institutions in Nigeria.

14. Public Finance

Topics:

- Meaning and objectives

- Fiscal policy and its instruments

- Sources of government revenue (taxes royalties, rents, grants and aids)

- Principles of taxation

- Tax incidence and its effects

- The effects of public expenditure

- Government budget and public debts

- Revenue allocation and resource control in Nigeria.

15. Economic Growth and Development

Topics:

- Meaning and scope

- Indicators of growth and development

- Factors affecting growth and development

- Problems of development in Nigeria

- Development planning in Nigeria.

16. Agriculture in Nigeria

Topics:

- Types and features;

- The role of agriculture in economic development;

- Problems of agriculture;

- Effects of agricultural policies and their effects;

- Instability in agricultural incomes (causes, effects and solutions).

17. Industry and Industrialization

Topics:

- Concepts and effects of location and localization of industry in Nigeria;

- Strategies and Industrialization in Nigeria;

- Industrialization and economic development in Nigeria;

- Funding and management of business organization;

- Factors determining the size of firms.

Study Objectives

Candidates should be able to:

- differentiate between location and localization of industry;

- identify the factors influencing the location and localization of industry;

- examine the problems of industrialization;

- appraise some industrialization strategies;

- examine the role of industry in economic development.

18. Natural Resources and the Nigerian Economy

Topics:

- Development of major natural resources (petroleum, gold, diamond, timber etc).

- Contributions of the oil and the non-oil sectors to the Nigerian economy.

- Linkage effects.

- Upstream/downstream of the oil sector.

- The role of NNPC and OPEC in the oil sector.

- Challenges facing natural resources exploitation.

19. Business Organizations

Topics:

- Private enterprises (e.g. sole-proprietorship, partnership, limited liability companies and cooperative societies)

- Problems of private enterprises;

- Public enterprises and their problems;

- Funding and management of business organizations;

- Factors determining the size of firms;

- Privatization and Commercialization as solutions to the problems of public enterprises.

20. Population

Topics:

- Meaning and theories;

- Census: importance and problems.

- Size and growth: over-population, under- population and optimum population.

- Structure and distribution;

- Population policy and economic development.

21. International Trade

Topics:

- Meaning and basis for international trade (absolute and comparative costs etc)

- Balance of trade and balance of payments: problems and corrective measures;

- Composition and direction of Nigeria’s foreign trade;

- Exchange rate: meaning, types, and determination.

Study Objectives:

You should be able to:

- examine the basis for international trade.

- differentiate between absolute and comparative advantages;

- distinguish between balance of trade and balance of payments and their corrective measures;

- highlight the problems of balance of payments and their corrective measures;

- examine the composition and direction of Nigeria’s foreign trade;

- identify the types of exchange rates;

- examine how exchange rates are determined.

22. International Economic Organizations

Topics:

- Roles and relevance of international organization e.g. ECOWAS, AU, EU, ECA, IMF, EEC, OECD, World Bank, IBRD, WTO, ADB and UNCTAD, etc to Nigeria.

Study Objectives:

Candidates should be able to:

- identify the various economic organizations and their functions;

- evaluate their relevance to the Nigerian economy

23. Factors of Production and their Theories

Topics:

- Types, features, and rewards;

- Determination of wages, interest, and profits;

- Theories: marginal productivity theory of wages and liquidity preference theory;

- Factor mobility and efficiency;

- Unemployment and its solutions

Study Objectives:

Candidates should be able to:

- identify the types; features and rewards of factors;

- analyse the determination of wages, interest, and profits;

- interpret the marginal productivity of liquidity preference theories

- examine factors mobility and efficiency;

- examine the types and causes of unemployment in Nigeria;

- suggest solutions to unemployment in Nigeria.

Frequently Asked Questions

Number of Questions JAMB Sets In Economics

The total number of questions JAMB asked in Economics is 40, with each question carrying 2.5 marks.

This means if after answering Economics, you were able to answer 30 questions correctly in JAMB you have been able to secure 75 marks for yourself.

Recommended Textbooks For Economics

To make sure your reading is inline with what your should know, JAMB has prepared a list of textbooks that will help you achieve that purpose, you can find the complete list of JAMB recommended Economics Textbooks.

Is JAMB Economics Syllabus For 2024 Out?

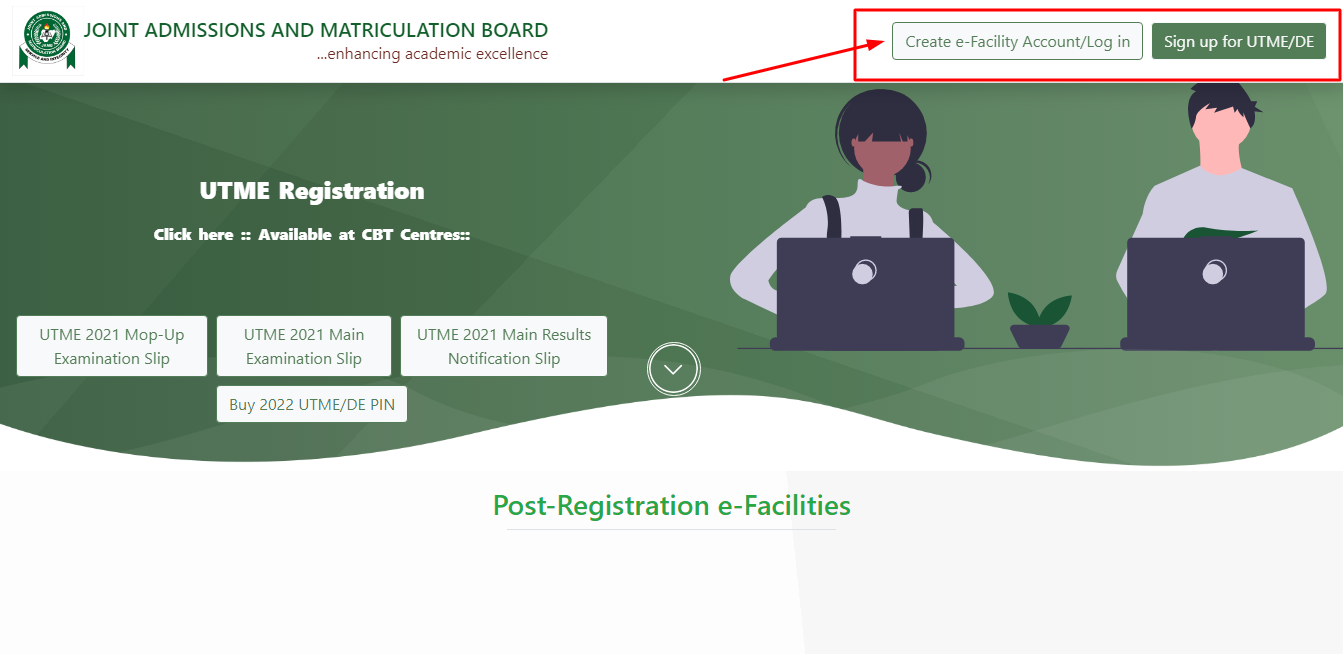

Yes, JAMB Syllabus for Economics is out and can be accessed here on DrugSavant or on JAMB IBASS

In Conclusion

It is advisable you go through these topics listed here, as they would help you have a more directed preparation and reading for JAMB Economics.

This will be all for now, I understand you may have a question or two to ask, feel free to drop them using the comment box below!

Ensure to share this with friends on Facebook, Whatsapp, or any other social media network you can connect them with…

Related Searches... a. economics jamb syllabus 2024 b. economics jamb syllabus pdf c. economics jamb syllabus 2023 d. government jamb syllabus 2024/2025

JAMB SYLLABUS FOR OTHER SUBJECTS... A. JAMB English Syllabus B. JAMB Mathematics Syllabus C. JAMB Syllabus For Physics D. JAMB Chemistry Syllabus E. JAMB Syllabus For Biology F. JAMB Economics Syllabus G. JAMB Syllabus For Christian Religious Studies (CRS) H. JAMB government Syllabus I. JAMB Syllabus for Commerce J. JAMB Literature in English Syllabus K. JAMB Computer Studies Syllabus